A and company ABC have made the hire purchase agreement of the car. It is very common for businesses to purchase major assets such as motor vehicles via a loan.

Independent Contract Agreement Microsoft Word Contractor Etsy Uk Contract Agreement Employee Handbook Agreement

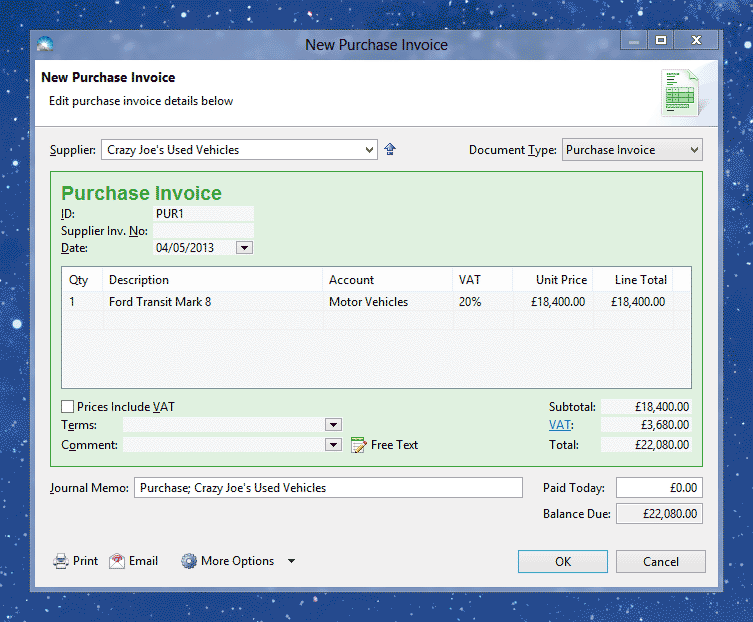

Purchase a fixed asset.

. Amount Owing to Director Current Liabity Cr. Debit vehicle for 20000. Purchased from Maruti Udyog Ltd.

If you are VAT-registered click More Options VAT Treatment Sale of Goods or Services to UK Customer. Given the amount of press that was generated re the governments variation of Capital Purchases. For assets bought using a loan or hire.

You record the motor vehicle in your accounting as a 15000 asset. Deposit Paid Current Assets Cr. Hence the total interest paid is 1237568 with the total loan from the finance company is 5657568.

Credit Note Payable for 20000. The interest rate per annum is 388 flat. B Hire price cash price interest for risk of giving asset on instalment.

The accounting entries would be as follows. To update hire purchase of motor vehicle. For help with your hire purchase setup ask the experts on the community forum.

Click on the Create Button. Assuming you signed a promissory note for the loan youd also make a journal entry in notes payable for. Road Tax Insurance Expenses Cr.

The asset account may be named vehicles or something more specific such as pick-up trucks You credit the cash asset account for 3000 the price of the down payment. 20000 12 712 Interest due. Lets assume that your business purchases a new van on January 1.

The entry to record the purchase at Jun 1 is as follows. For accounting point of view both hire purchase and instalment payment system are same. You made a deposit of 20000.

You create both the Interest in Suspense and Hire Purchase account as a Long-Term Liability since the payment term is more. CR BS HP Liabilities 7000. Vehicle 3023636 CAP code this will deal with gst component of the car purchase.

Purchasing a vehicle from a scrap yard such as a used rv salvage yard or automotive recycling center can be a way to get a discounted price on a car. Before accounting we should know following things. Enter the total amount for the loan on the Credit side.

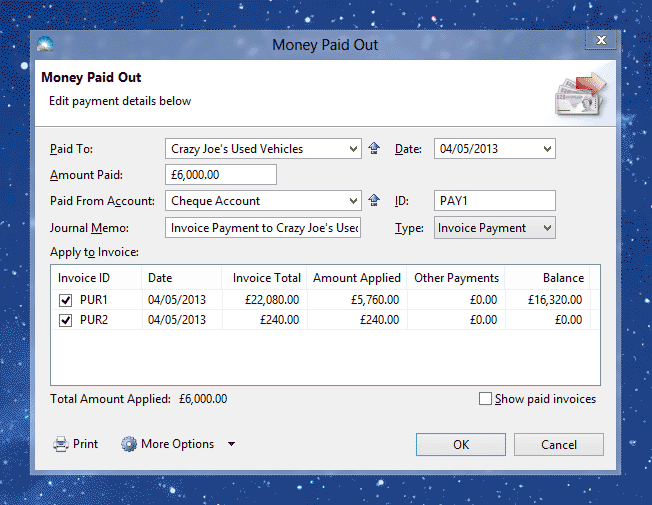

Follow the step 1 until 3. In addition the same VAT issues mentioned in Step 1 also apply to this sales invoice. In addition to this you pay a vehicle registration fee of 250 a title fee of 100 an emissions testing fee of 75 documentation fees of 50 giving a total of 25475.

With regards to the journal entry you would usually debit the asset and credit method of payment usually a bank loan account. You purchase a Motor Vehicle Car on a hire purchase basis over a period of 7 years 84 months. The price of the car is 64200 60000 plus 4200 GST with the interest rate of 4.

Create a new purchase order for the car. Learn how to get a copy of a driving record if you need to create or renew an insurance policy hire a driver or screen volunteers. DR BS Motor Vehicles 7000.

Select a service and find the location closest to you. If the total payments are only 8225 the HP company is not charging any interest. 15000 with 7 GST Code Row2.

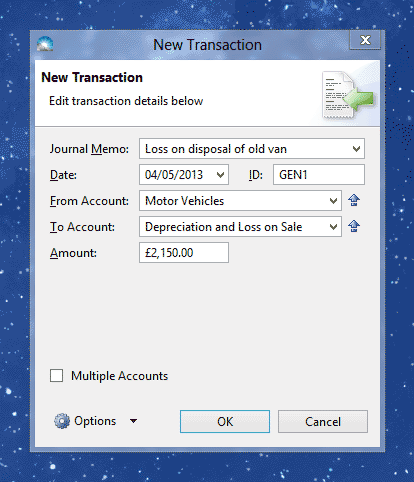

Cost of Office Equipment FA. Record the sale of the old van. In this weeks blog we will look at a purchase via Chattel.

Bank Current Assets 2 To Update Hire Purchase of Motor Vehicle. Motor Vehicle ABC XXXX Fixed Asset Dr. Delhi Tourist Service Ltd.

A motor van on 1st April 2009 the cash price being Rs 164000. To record the loan amount follow the steps provided below. The bookkeeping behind an asset purchase via a Chattel Mortgage.

Purchase another persons driving record. Initial payment 10000 30 3000. Record the purchase as a simple bank payment Other Payment or Purchase Invoice if youve received one from your supplier.

Interest in Suspense LTL. The banking option is usually if you have paid for the asset at inception in full. You buy a new car for 25000 including tax.

Deposit Paid Current Assets Cr. Create a credit card account for the finance company. 22 - purchase a vehicle for the business for 44000 including GST useful life of 5 years and residual value 10000 to fund the purchase the bank established a new loan account MV loan and the bank paid this amount directly to the vendor.

Create a credit card account for the finance company. How to record the purchase of a fixed asset such as vehicles machinery or office equipment. 1 To Record Deposit Paid.

The purchase was on hire purchase basis Rs 50000 being paid on the signing of the contract and thereafter Rs 50000 being paid annually on 31st March for three years Interest was charged at 15 per annum. A Cash price is that price which will be paid if any asset is purchased on cash without installment. Create a purchase credit note for 6240 allocated to the Motor Vehicles account.

Id double check this as your car licence papers will have a stamp duty and gst component. Click your business name in the top-right corner of any page in MYOB Essentials then choose Accounts list. How to record a hire purchase transaction in quickbooks accounting software solarsys.

It is also unusual for the deposit paid to be less than the VAT. You have put down a deposit down payment of RM7500000 which means the financed amount is RM10000000. Driving record Buy a copy of your WA driving record.

Your car engine is connected to a number of parts and the frame of the vehicle. You are acquiring a motor vehicle that costs RM17500000 with a 5-year hire purchase plan. If you normally account for.

This will need to be recorded as an asset so that it appears on your financial statement. When the customer agrees to buy an asset under a hire purchase contract heshe is required to complete the hire purchase application form which. You have an car that originally cost 15000 and has depreciated by 5000.

The monthly payment over 3 years is equal to 200. You need to look at the HP agreement and see what HP charges interest have been added to the cash price including VAT. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense.

They can use a commercial bank loan but often finance is purchased by way of either Hire Purchase or a Chattel Mortgage. At end of year to compute the interest you have to figure the amount of interest due. For example you purchase a vehicle with a 20000 note for for 1 year with an apr 12 dated Jan Jun 1.

You part exchange your old car for 7500. Select the Asset Account that you want the loan amount to be linked with. You record the bill into QuickBooks with the accounts under the Expense tab as.

The car needs to have a tax code of CAP or GCA depending on your version of MYOB Stamp duty has a tax code of FRE. Click on the Account Dropdown options and Select Liability Account. Check the motor electrical connector with the key on and the fan switch on.

Good day Usually to account for a vehicle purchase you would either have to process a Journal entry or a Banking transaction. Make sure you have the correct Fixed Assets ledger accounts. Dr disposal of motor vehicle account The double entry for this.

Find out how to get a copy of your Washington driving record. Hire Purchase ABC XXXX Current Liability. This article demonstrates how you can record a hire purchase transaction of an asset with monthly instalment.

The van cost 50000 and your business paid cash for the van.

How To Record A Hire Purchase Agreement Solar Accounts Help

Realtimme Cloud Solutions Helpfile

Suzuki Swift 50 Mobil Mobil Mewah Mobil Baru

Hire Purchase System Part I Wikieducator

Vehicle Ownership Transfer Letter How To Write A Vehicle Ownership Transfer Letter Download This Vehicle Owner Letter Templates Lettering Download Lettering

Accounting For Hire Purchase Accounting Education

Accounting Basics Purchase Of Assets Accountingcoach

Best Tourist Places To Visit In India By Month Cars For Sale Luxury Car Hire Luxury Car Rental

New Fe Holden Holden Australia Holden Vintage Advertisements

How To Record A Hire Purchase Agreement Solar Accounts Help

How To Record A Hire Purchase Agreement Solar Accounts Help

Solved Journal Entries For Fixed Asset Sale Vehicle With

Vintage 1950s American Wedding Car Classic Car Wedding Wedding Car American Wedding

Hire Purchase Agreement Format How You Can Attend Hire Purchase Agreement Format With Minima Purchase Agreement Words Agreement

How To Record A Hire Purchase Transaction In Quickbooks Accounting Software Solarsys

Accounting For Hire Purchase Accounting Education

Hire Purchase Accounts Ppt Download

Do You Know The Difference When Buying A Car Between A Personal Loan Hire Purchase And Personal Contract Plan Car Buying Credit Record Personal Loans